Minnesota Residents Urged to Exercise Caution as Stimulus Payments Disbursed via Third-Party Vendor

Minnesota Residents Urged to Exercise Caution as Stimulus Payments Disbursed via Third-Party Vendor

Minnesota residents are currently receiving their long-anticipated income tax rebate checks, a development that should be met with caution due to an unconventional aspect of the distribution process.

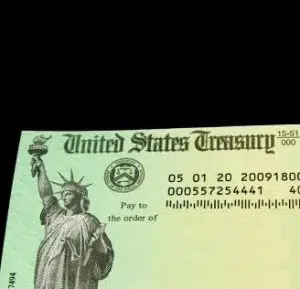

These checks, while genuine, may resemble unsolicited or junk mail, raising concerns among recipients.

The origin of these checks is Submittable Holdings, a Missoula, Montana-based company specializing in form-building and funds distribution software.

This discrepancy in the expected source of funds may create confusion among taxpayers who were anticipating checks from the Minnesota Department of Revenue.

It is crucial to clarify that these checks are indeed legitimate.

Submittable Holdings is a reputable entity that the state of Minnesota has engaged as a partner to facilitate the distribution of the 2021 One-Time Rebate Payments.

This partnership builds on their previous collaboration during the Frontline Worker Payment initiative, establishing their credibility in handling such matters.

Stimulus Disbursement Details

In addition to Submittable Holdings, the state is also working in conjunction with U.S. Bank to ensure efficient payment processing.

The decision to involve third-party entities stems from the ongoing property tax refund season.

The Minnesota Department of Revenue has opted for this approach to prevent any potential disruption to property tax refund disbursements.

Eligible Minnesota residents can anticipate the following payments:

- $520 for Married Couples: Applicable to those who filed a joint 2021 income or property tax return with an adjusted gross income of $150,000 or less.

- $260 for Individuals: This sum will be provided to individuals with a 2021 adjusted gross income of $75,000 or less.

- Additional $260 for Dependents: Families with dependents may receive an additional $260 for each dependent, up to a maximum rebate of $1,300 per family.

Distribution will take place in two phases, with direct deposits being the initial method followed by mailed checks.

Individuals who selected direct deposit during their 2021 tax filings or updated their banking information earlier in the summer may have already received their payments.

Paper checks will continue to be mailed throughout September, with the department targeting the issuance of nearly 2.1 million rebate payments by month-end.

Procedures for Unreceived Payments

For those who do not receive their rebate payments by October, the Minnesota Department of Revenue advises a review of eligibility requirements on their official website.

If eligibility is confirmed, individuals are encouraged to contact the department at 651-565-6595 or via email at mntaxrebate@submittable.com to engage with a customer assistance representative for further assistance and payment tracking.

In conclusion, while the distribution of tax rebate checks is underway, recipients are urged to exercise caution and avoid disregarding envelopes that may appear as junk mail.

These payments are genuine, originating from a trusted partner, and aim to provide financial relief to eligible Minnesota residents.